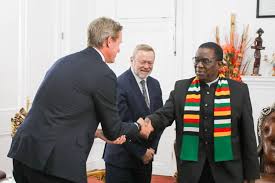

In early June, Britain’s Africa minister Lord Collins visited Harare to engage with Zimbabwean President Emmerson Mnangagwa, focusing primarily on boosting trade and investment between the two countries. This outreach comes amid growing UK interest in Zimbabwe’s rich mineral deposits, which are critical for renewable energy technologies and essential to Britain’s strategy to reduce dependence on Chinese supplies. While human rights concerns were acknowledged during the visit, with some issues raised to Zimbabwe’s acting foreign minister, the UK government has opted for a pragmatic approach that prioritizes economic cooperation over direct confrontation about political repression and democratic backsliding.

Despite this pragmatic stance, opposition voices remain vocal, especially among Zimbabweans in the UK diaspora who protested against the regime’s participation in high-profile events. Internally, investors face challenges due to Zimbabwe’s unpredictable regulatory environment and centralized political control, which contribute to policy uncertainty and elevated business risks. Nonetheless, the UK government sees potential rewards in tapping into Africa’s vast mineral reserves, which include copper, nickel, cobalt, and lithium—key resources needed to support the global transition to clean energy and meet net zero goals.

Recent public criticism of Chinese investors by Zimbabwean officials indicates a desire to diversify partnerships and reduce overreliance on China. The UK’s renewed engagement aims to capitalize on this opening, offering a mutually beneficial relationship that could help Zimbabwe restructure its debt and develop its minerals sector more sustainably. Nonetheless, the path is complicated by activist opposition, investor caution, autocratic governance, and intense competition from Chinese interests, making the UK’s efforts a calculated but uncertain gamble.

end //..